What Are Capital Expenditures CapEx?

Many companies usually try to maintain the levels of their historical capital expenditures to show investors that they are continuing to invest in the growth of the business. If the asset’s cost is relatively small, it may be expensed rather than capitalized. For example, if a company purchases office supplies such as paper and pens, these costs would be expensed rather than capitalized. Accordingly, these kinds of capital expenditures are listed on the balance sheet as an investment rather than on the income statement as an expense.

Where can I find capital expenditures in financial statements?

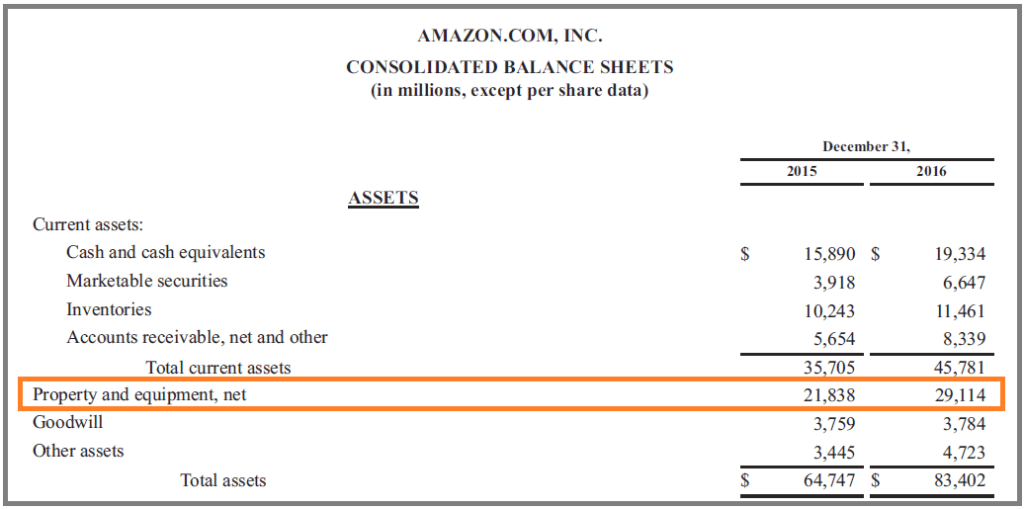

Hence, the depreciation expense is treated as an add-back in the cash from operations (CFO) section of the cash flow statement (CFS) to reflect that no real cash outlay occurred. While depreciation expense reduces the carrying value of fixed assets (PP&E) on the balance sheet, there is no actual cash outlay. Capital expenditure, often how to find capex abbreviated as “Capex,” describes the funds spent by a company to acquire, upgrade, and maintain physical fixed assets, such as property, buildings, and equipment. This formula is derived from the logic that the current period PP&E on the balance sheet is equal to prior period PP&E plus capital expenditures less depreciation.

Order to Cash

Property, Plant, and Equipment (PP&E) represents the book value/accounting value of a firm’s land and buildings, vehicles, machinery, etc. Broadly speaking, all of these types of items – buildings and property, equipment, vehicles, etc – tend to be classified as “Property, Plant, and Equipment”. The thinking was that these expenses are necessary to generate revenue on a day-to-day basis. Sometimes, even though the investment is made after careful consideration and analysis, the returns from the CapEx can be uncertain.

How do Capital Expenditures impact Free Cash Flow and Valuation?

CapEx is calculated as the change in property, plant, and equipment (PP&E) plus the current period depreciation expense. The current period depreciation expense appears as a line item on the income statement. You know how to calculate capital expenditures, locate and read off the correct items from the income statement and balance sheet, and even calculate the CapEx ratio. In simple terms, it represents expenditures to enhance a company’s operational efficiency or expand its productive capacity.

Certain business startup costs, business assets, and improvements are the types of business expenses that can be considered capital expenditures. Some business startup costs can be considered capital expenditures while others are counted as operating expenses. Additionally, with scenario analysis, you can quickly build and run scenarios to compare the effects of unprecedented economic events or business decisions against the base-case forecast. This will further help to maintain the financial stability of the businesses and avoid cash deficits.

Organizations making large investments in capital assets hope to generate predictable outcomes. The costs and benefits of capital expenditure decisions are usually characterized by a lot of uncertainty. During financial planning, organizations need to account for risks to mitigate potential losses, even though it is not possible to eliminate them.

In this example, the company’s Capital Expenditure during the specified period amounts to $300,000. R&D CapEx involves investments in research and development activities aimed at innovation, product development, and technological advancements. This type of CapEx is generally focused on developing new systems or technologies, creating new tech stacks, or even revamping existing ones. Capital expenditures are also subject to accumulated depreciation—the loss in value those assets sustain with age. So back to our office chairs—if you bought them in bulk and their cost surpassed your expensing threshold, they could be CapEx. Accelerate your planning cycle time and budgeting process to be prepared for what’s next.

Over time, this asset’s value is gradually reduced through depreciation expense, reflecting the asset’s consumption or decrease in value. The incorporation of the net capital expenditure formula enhances the competitiveness and long-term productivity of the organization. It attracts growth through investments in assets such as machinery, infrastructure, and technology. In the CapEx formula, the change in PPE reflects the net investment made in tangible assets during the accounting period.

Plus, you can see areas of your business where you can improve and even cut costs. Capital expenditures present several challenges for businesses, including financial constraints, risks of overinvestment, accounting complexities, and the need for long-term planning. Managing these challenges requires a comprehensive understanding of a company’s financial position, strategic objectives, and market dynamics. When a company uses funds to purchase these items, they are recorded as part of the total PP&E on the balance sheet. Costs that are related to future revenues, such as buildings, patents, or machines, are typically considered capital expenditures. Unlike operating expenses (OpEx), capital expenditures are not recorded in full during the period in which they were incurred.

- R&D CapEx involves investments in research and development activities aimed at innovation, product development, and technological advancements.

- CapEx is the investments that a company makes to grow or maintain its business operations.

- In simple English, CapEx is simply the difference between current and previous PP&E, plus depreciation.

- The income statement reports income at the top and expenses below, with the net income– or net profit– reported on the bottom line.

- Capital expenditure, or CapEx refers to allocating funds toward acquiring, upgrading, or sustaining long-term assets that are crucial for a business’s functioning.

- Below is a screenshot of a financial model calculating unlevered free cash flow, which is impacted by capital expenditures.

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. In the final two steps, we’ll project PP&E and then back out the implied capital expenditure amount using the formula mentioned earlier. For example, the act of repairing a roof, building a new factory, or purchasing a piece of equipment would each be categorized as a capital expenditure. This type of financial outlay is made by companies in an effort to increase the scope of their operations or to add some future economic benefit to the operation. A company may spend money on software, hardware, or other technological solutions to improve its operations, automate certain tasks, or enhance its products.